Changes from every bureau circular, delivered straight to your policy admin system

Why SpatialKey?

faster risk assessment

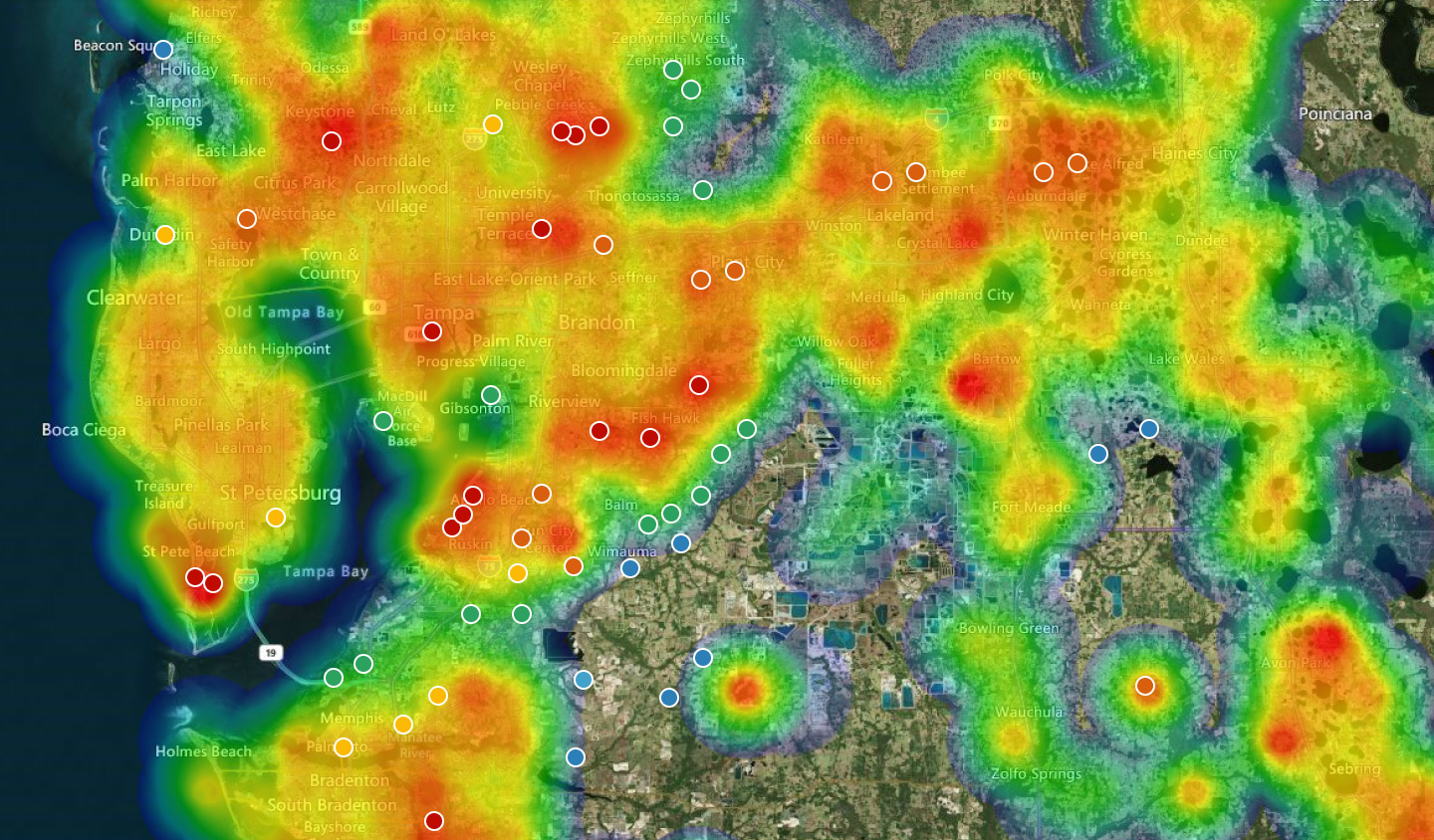

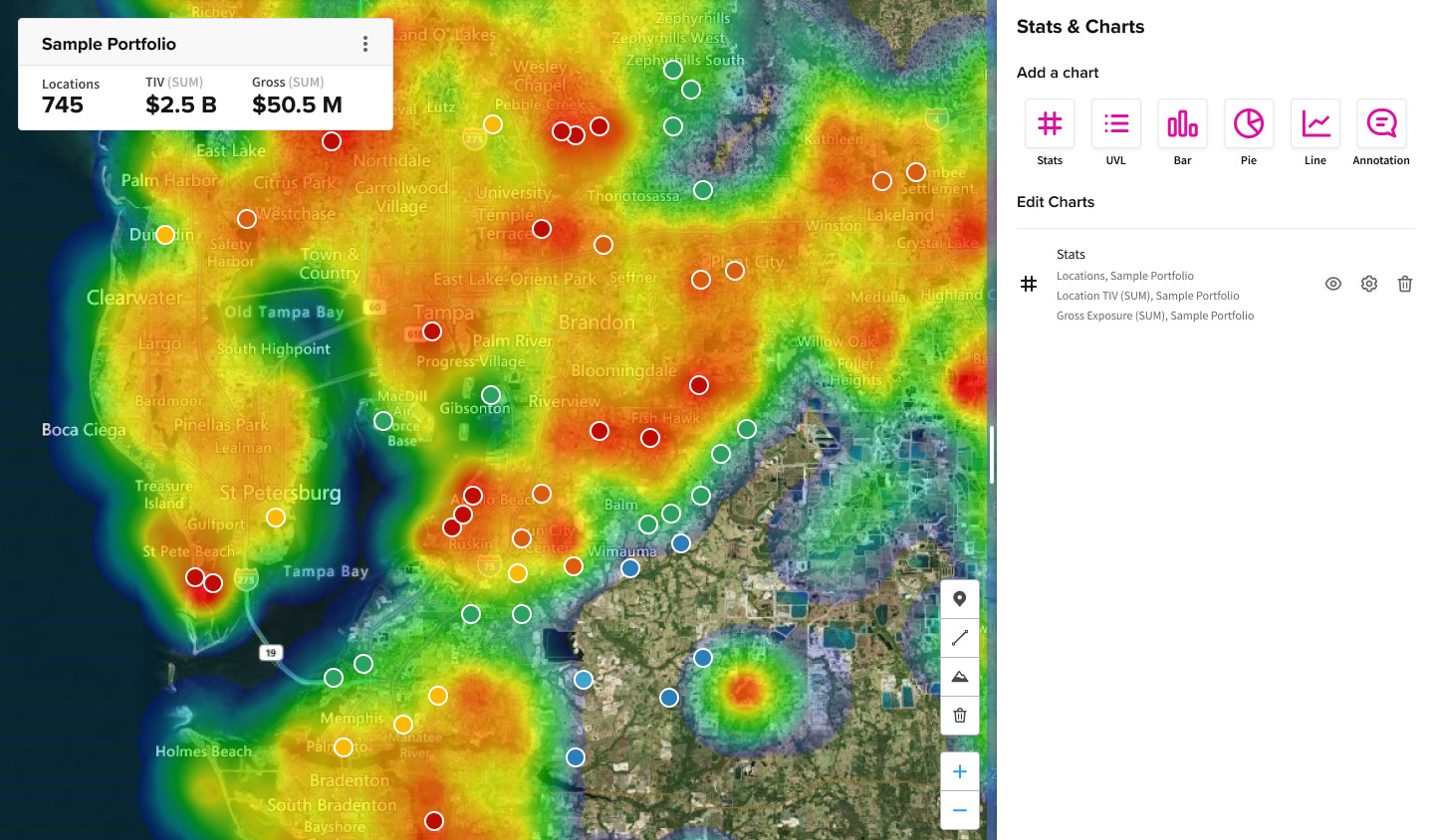

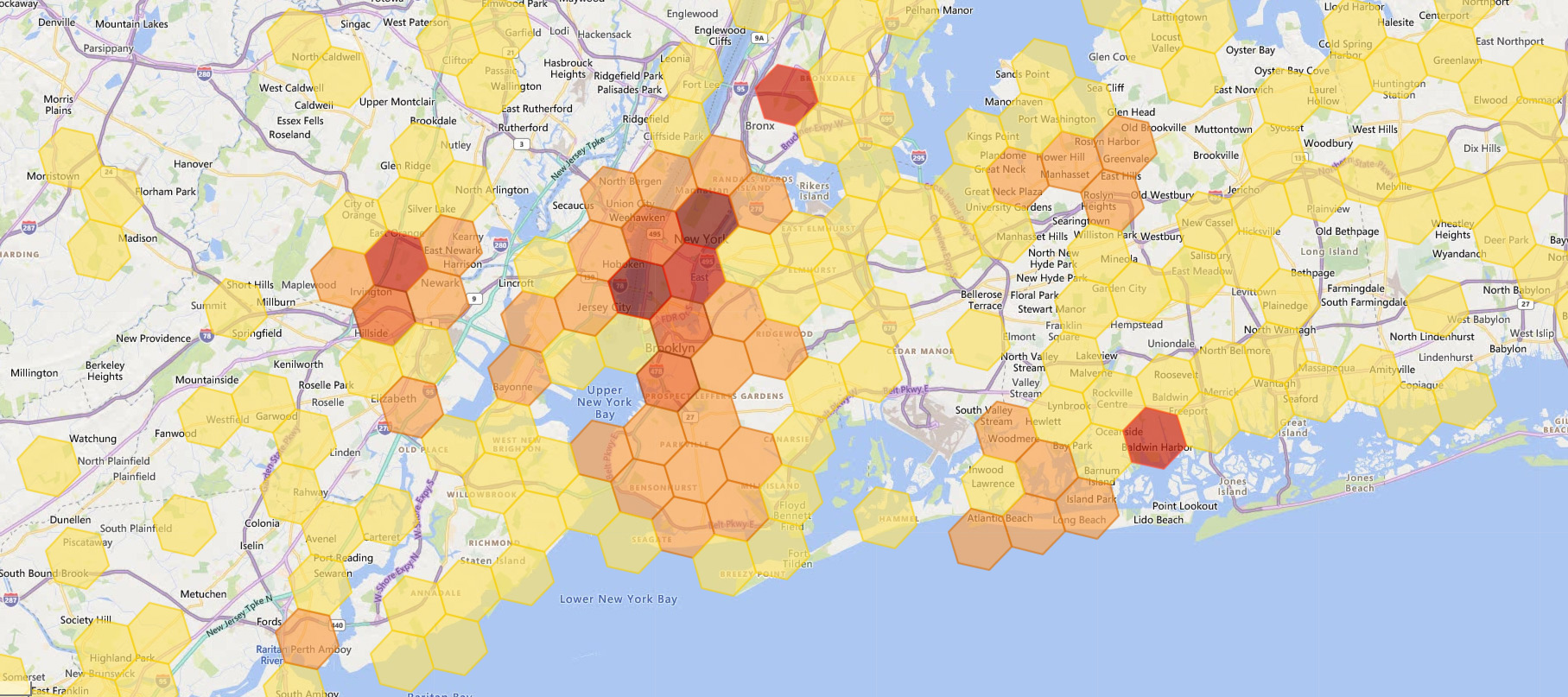

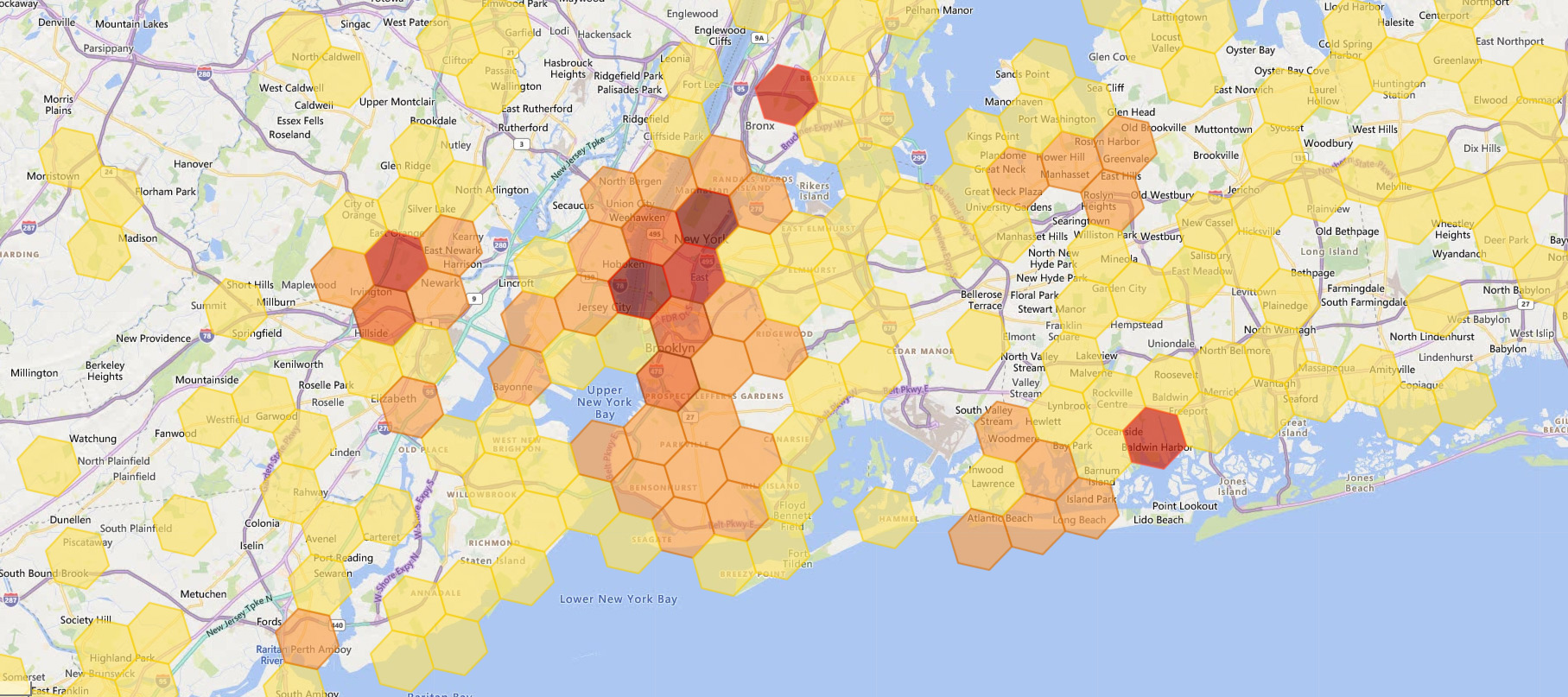

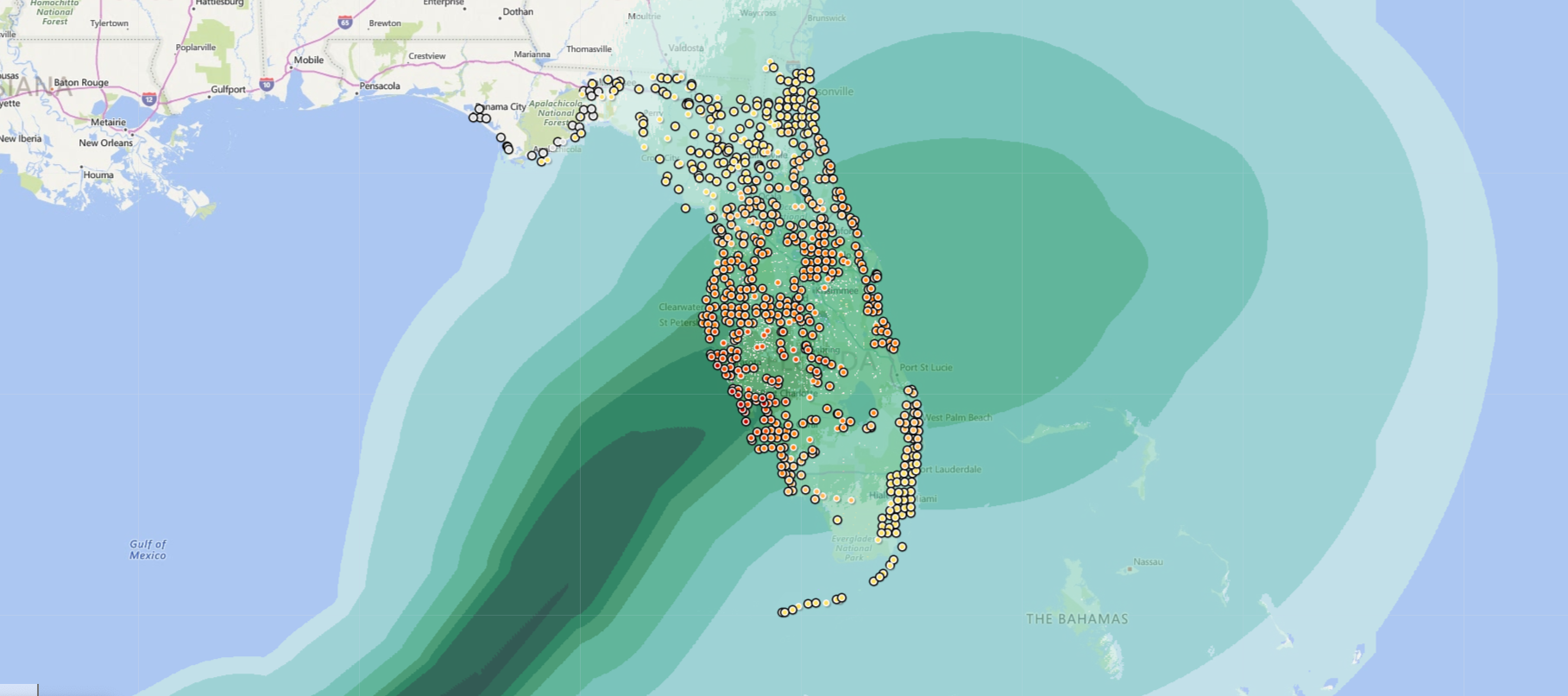

Assess risk quickly by identifying correlations among exposures, hazards, and models

Real results, delivered

Get started

Transform your underwriting and claims operations with the best location risk intelligence on the market. Book a demo and an Insurity expert will be in touch to show you SpatialKey.

Customer Stories

ROI

Why SpatialKey?

Book a Demo

Customer Stories

ROI

Why SpatialKey?

Book a Demo

Risk intelligence, built specifically for insurance

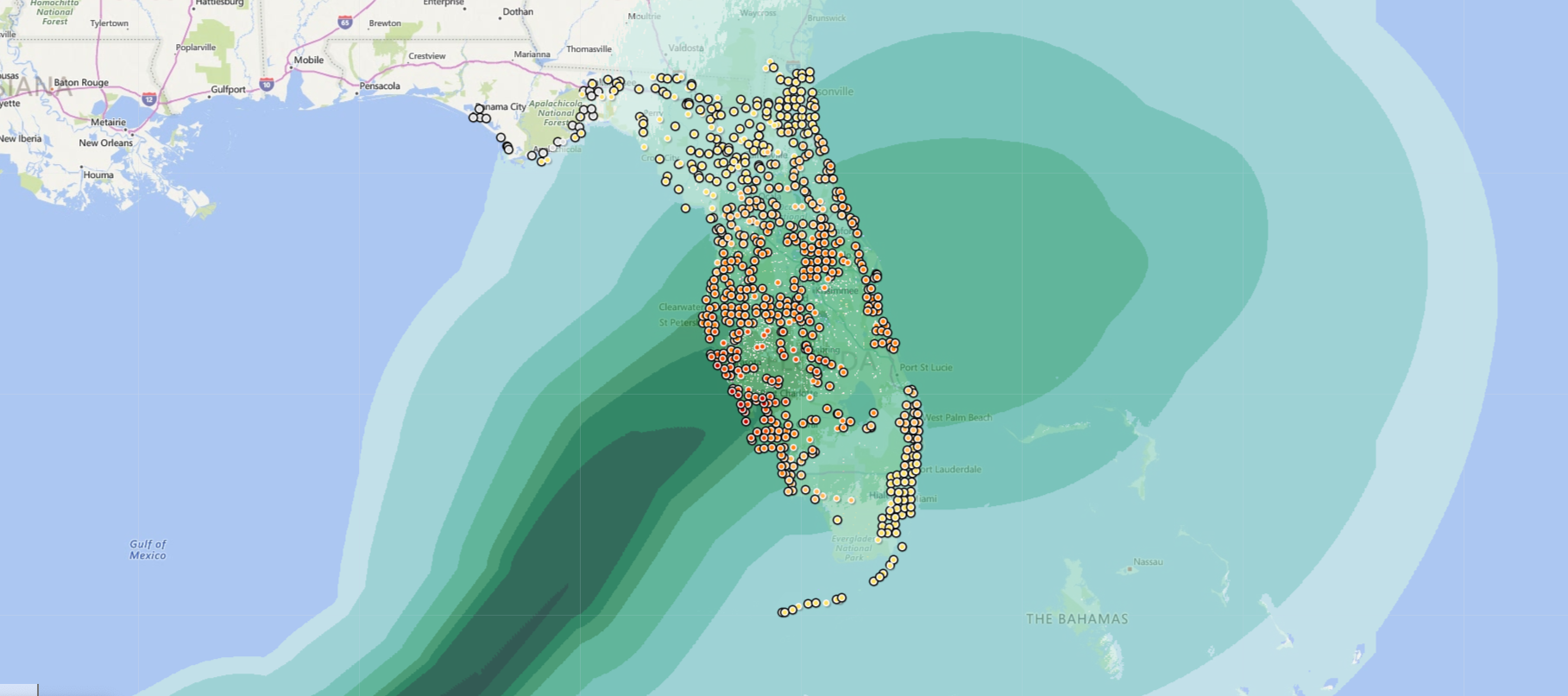

See risk clearly. SpatialKey arms insurers with deep hazard insights to drive smarter underwriting, build stronger portfolios, and enable faster disaster response.

Book a Demo

50%

lower claims cost

5%

Minimize claims costs when catastrophe strikes with automated event alerts and proactive policyholder engagement �

faster quoting

25%

Streamline underwriting decisions with access to 70+ third-party data providers at your fingertips �

less time spent on portfolio analyses

67%

Drive efficiency by quickly visualizing risk contributors, risk position, and market share

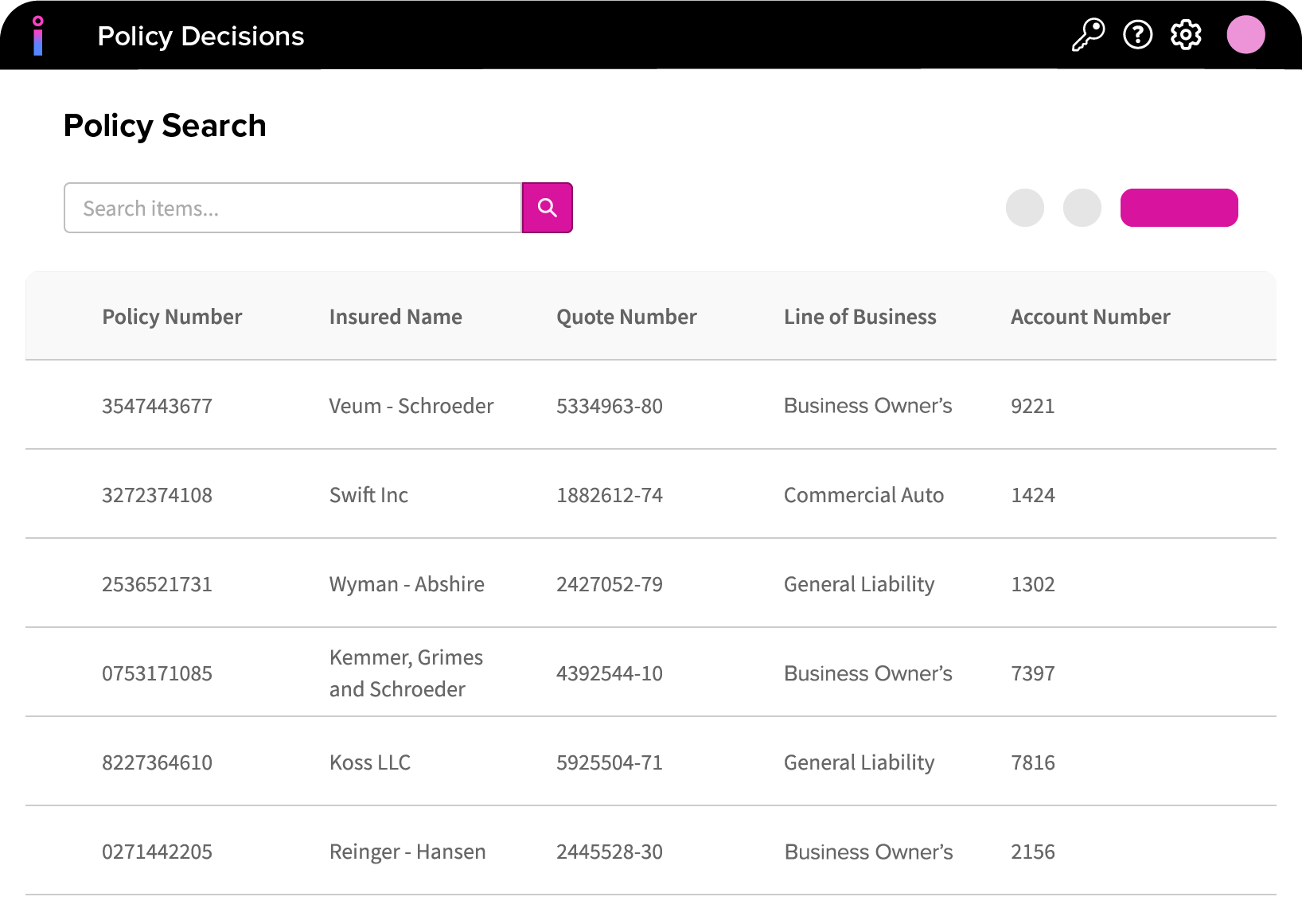

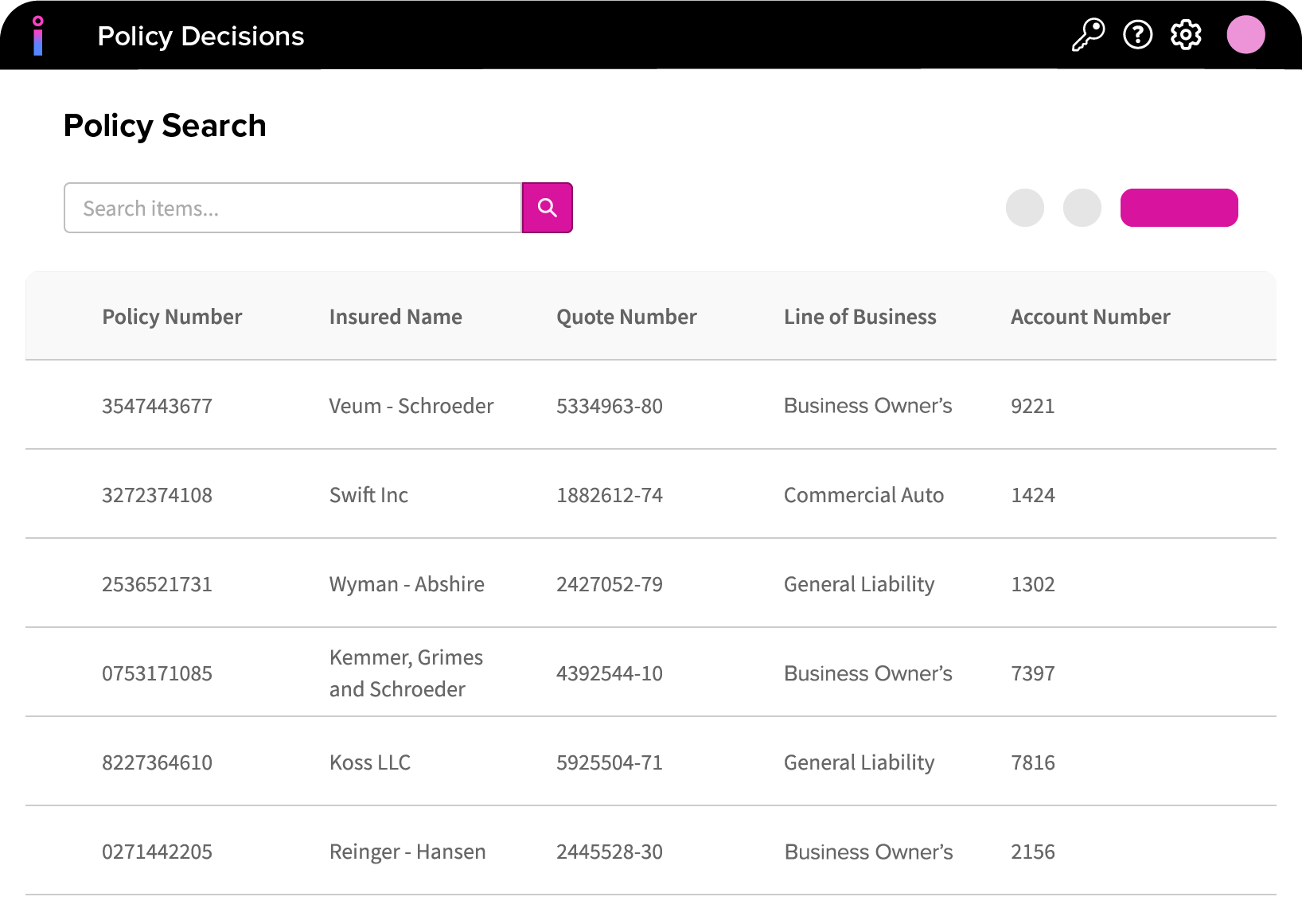

Save 50% on total cost compared to other policy admin systems

Policy Decisions reduces your total cost of ownership through automated policy administration, integrated regulatory compliance, and API-enabled connectivity, streamlining your operations and maximizing profitability, so you can stay competitive while controlling costs.

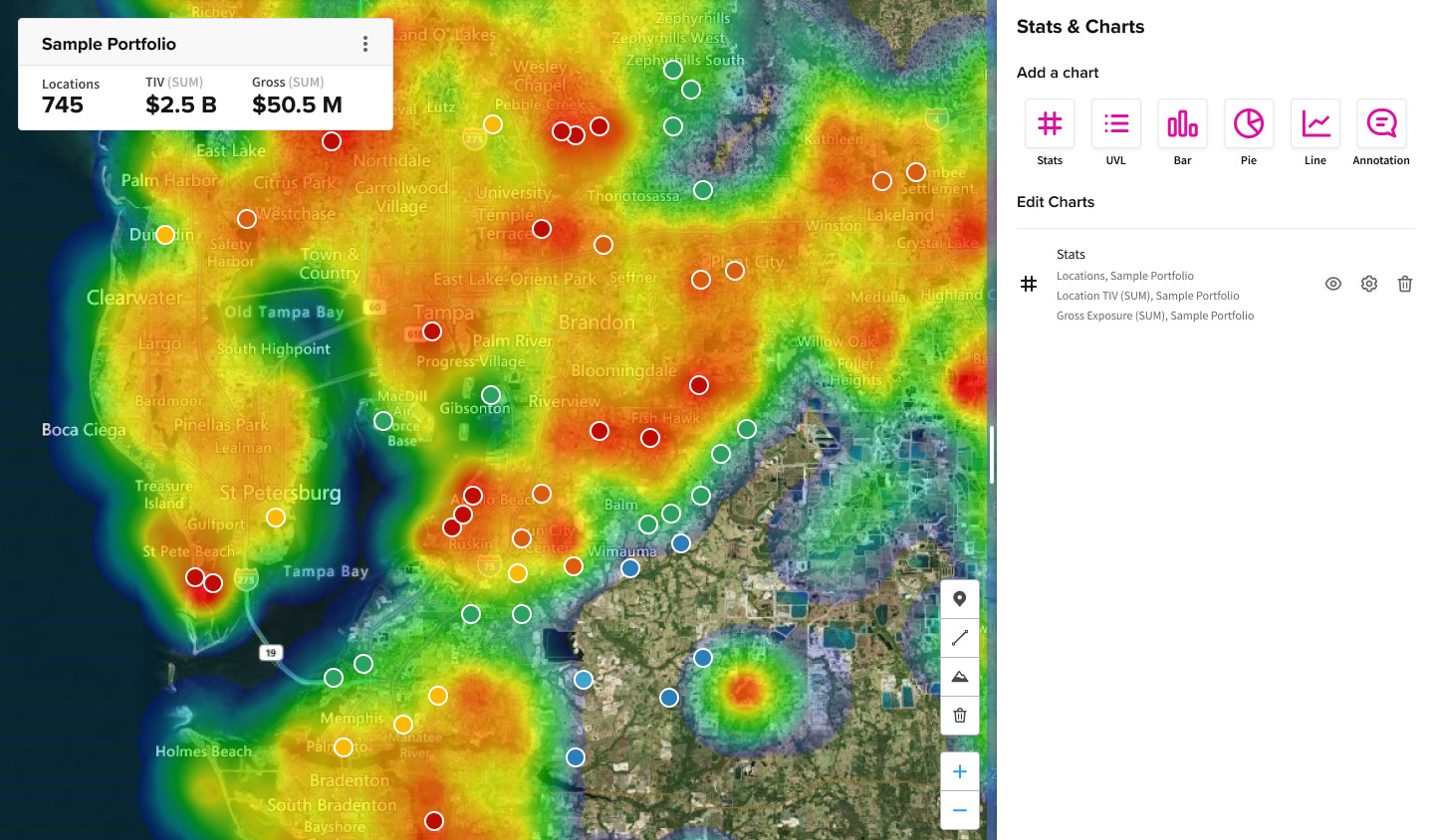

Instant insights at the point of decision-making

Deliver risk insights in real time – right where underwriters actually work. SpatialKey embeds high-value data and visual analytics directly into underwriting and quoting workflows via simple API calls, supporting both location and policy financial calculations. This gives decision-makers the clarity they need, exactly when and where they need it.

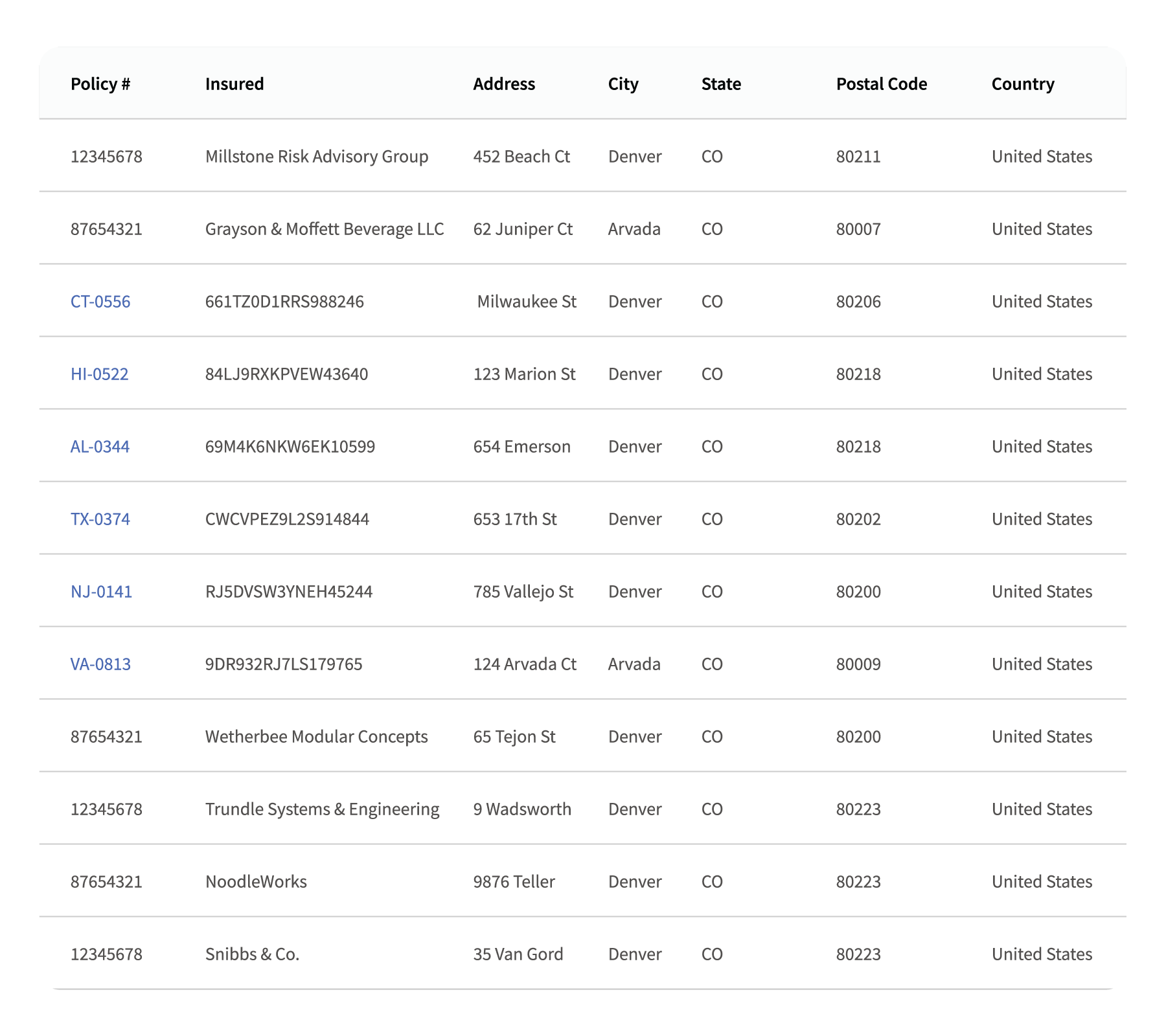

Quickly process large policies with 5,000+ trucks or properties at one time

Policy Decisions seamlessly imports, manages, and processes large schedules with thousands of vehicles or locations on one policy at the same time so you can underwrite and issue policies faster, without manual data entry and consistency errors.

Watch the Video

“We’ve used Insurity’s Policy Decisions now for 20 years and it’s been the�backbone of our underwriting and policy admin system. It’s a product that’s easy to use, it’s efficient, and it’s correct – it’s been a real workhorse for us.”

Michael Brady, VP, Underwriting

Read More

“I can’t say enough about the Insurity team’s dedication to working closely with the Columbia business and IT teams to ensure this was the smoothest, quickest migration we’ve ever had.”

Scott Mackey, SVP, Chief Underwriting Officer

Watch the Video

“The Insurity Policy Decisions system we have, I would estimate, saves us 20%,�perhaps more, in time savings from the processes and manual tasks we did

previously. Policy Decisions is a very flexible product.”

Michael Brady, VP, Underwriting

Read More

“It’s no small feat to go from a data center-hosted environment to the cloud, but we worked closely with the Insurity team to see what a successful upgrade would look like…The whole process of moving to the cloud and a new user interface with Insurity has resulted in nothing but positive outcomes for Zurich.”

Eric Sellenberg, Technical Director

Watch the Video

“We trust Insurity more than other vendors for the compliance with ISO rules, with state regulatory rules. The amount of effort Insurity puts into making sure the rules, the rate sets, and tables are all correct is what sets them apart.”

Michael Brady, VP, Underwriting

What customers are saying

Watch the Video

“We’ve used Insurity’s Policy Decisions now for 20 years and it’s been the backbone of our underwriting and policy admin system. It’s a product that’s easy to use, it’s efficient, and it’s correct – it’s been a real workhorse for us.”

Michael Brady, VP, Underwriting

Read More

“I can’t say enough about the Insurity team’s dedication to working closely with the Columbia business and IT teams to ensure this was the smoothest, quickest migration we’ve ever had.”

Scott Mackey, SVP, Chief Underwriting Officer

Watch the Video

“The Insurity Policy Decisions system we have, I would estimate, saves us 20%, perhaps more, in time savings from the processes and manual tasks we did previously. Policy Decisions is a very flexible product.”

Michael Brady, VP, Underwriting

Read More

“It’s no small feat to go from a data center-hosted environment to the cloud, but we worked closely with the Insurity team to see what a successful upgrade would look like…The whole process of moving to the cloud and a new user interface with Insurity has resulted in nothing but positive outcomes for Zurich.”

Eric Sellenberg, Technical Director

Watch the Video

“We trust Insurity more than other vendors for the compliance with ISO rules, with state regulatory rules. The amount of effort Insurity puts into making sure the rules, the rate sets, and tables are all correct is what sets them apart.”

Michael Brady, VP, Underwriting

What customers are saying

Drag to reveal more

Book a Demo

less time spent on compliance

20%

Stay up to date with regulatory changes with the latest bureau content delivered straight into your rates, rules, and forms

increase in DWP from new lines

25%

Enter new markets and launch new lines of business quickly with full regulatory support in all 50 states

faster quoting time

35%

Quote new commercial insurance products faster than ever with an intuitive interface

premium written annually

$7B+

Drive business growth on a proven platform designed for large, complex commercial books

Real results, delivered

Drag, drop, done

Bring your data as-is – your field names, your structure. No rigid data format required, unlike other insurance-focused geospatial tools. SpatialKey also supports industry-standard formats like RMS and AIR out of the box, so you can plug in your data without rework.

70+ different data providers available out of the box

Access the industry's richest hazard intelligence in a single platform. SpatialKey eliminates the need for multiple tools, vendors, and custom integrations by connecting you to enterprise-grade risk intelligence from over 70 hazard and event data providers.

Read More

“I can’t say enough about the Insurity team’s dedication to working closely with the Columbia business and IT teams to ensure this was the smoothest, quickest migration we’ve ever had.”

Scott Mackey, SVP, Chief Underwriting Officer

Read More

“Unlike other carriers that wait for claims to come to them, Acuity hits the ground running thanks to our advanced technology [powered by Insurity’s SpatialKey]. We immediately triage claims, deploy our claim resources, coordinate with repair resources, and help people put their lives and businesses back together.”

Jamie Loiacono, Vice President of Claims

Watch the Video

“SpatialKey is an amazing underwriting tool because as our underwriters are evaluating a risk, they can pull up and see what other risks we have in the area. Maybe we have too much concentration in the area or maybe we don't have any. It's fabulous for seeing if we want to make an underwriting decision based on what other risk we have already written in the area.”

Christine Moreland, Executive Product Manager

17

Watch the Video

“SpatialKey helps us with our binding moratoriums and active wildfires is a big one we rely on it for. If there is a wildfire in an area we're looking to write a risk, it'll stop that from happening so that we don't bind a risk we shouldn't.”

Christine Moreland, Executive Product Manager

Read More

“SpatialKey now provides event notifications to our clients in near real-time, with actionable and customized information. Holborn and [Insurity] both understand our clients’ needs for a competitive advantage. This new system includes features stemming from our ongoing collaboration and we are delighted to have had the opportunity to partner with [the team] to develop a high-tech, flexible solution to address event management and response.”

Scott Rosenthal, SVP & Head of Analytics

Read More

“[SpatialKey] helps us assess and present aggregate risk in a far more visually compelling way. Its speed, interactivity, and ability to handle large data sets enable us to work faster with greater flexibility.”

Matt Stephens, Head of Exposure Analysis

Read More

“With Insurity, we can offer our clients unprecedented access to the right data at the right time to manage their response to catastrophes. Insurity’s intuitive, purpose-built applications and compelling visual analytics help us deliver business-critical event intelligence in moments. We look forward to many breakthroughs in insurance analytics with Insurity.”

EVP Catastrophe Management Services

Read More

“Data analytics is a key differentiator in how we operate, compete, select risks, and proactively manage our portfolio. With SpatialKey, we have empowered our underwriters and analytics team with actionable information to improve risk selection and portfolio performance.”

Jen Klobnak, Chief Operating Officer

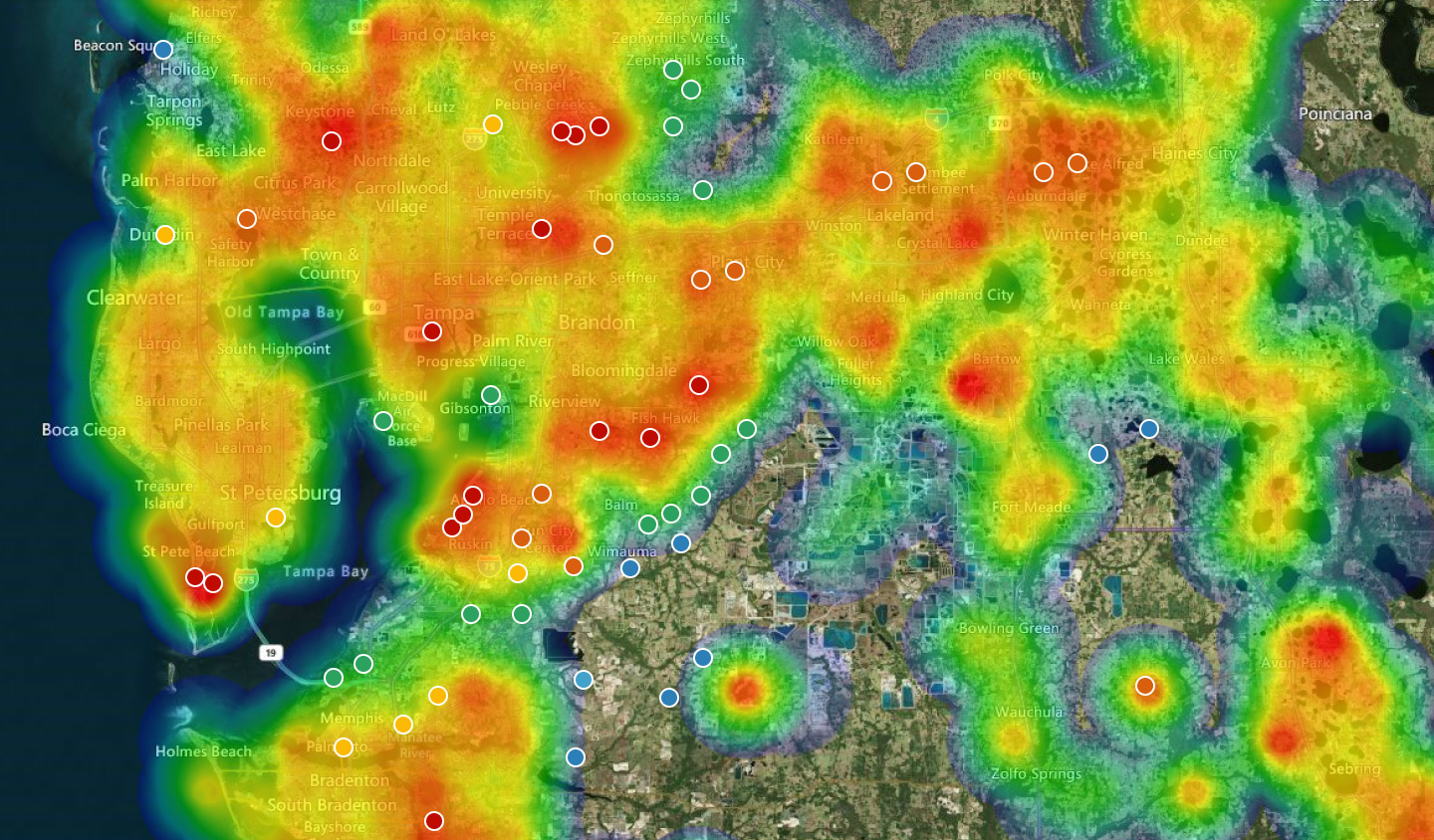

Automated risk control to protect your portfolio

Stay ahead of weather events and confidently manage accumulation risks at the location and policy level – no manual oversight required. SpatialKey proactively controls your aggregation exposure through built-in moratorium logic and event threshold triggers.

From login to live in minutes, and built to scale

No lengthy implementations or IT marathons required. SpatialKey is fully packaged and ready to go, so you can launch in minutes – not weeks. Scale across teams, lines of business, and geographies with simple integration options and zero operational disruption.

Policy Decisions eliminates the need for extensive regulatory tracking systems, large compliance teams, and complex implementation efforts by monitoring, analyzing, and delivering changes to rates, rules, and forms directly to your system.

Automated risk control to protect your portfolio

Stay ahead of weather events and confidently manage accumulation risks at the location and policy level – no manual oversight required. SpatialKey proactively controls your aggregation exposure through built-in moratorium logic and event threshold triggers.

Watch the Video

Read More